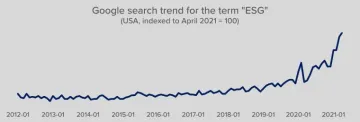

You’re not imaging it – the recent proliferation of Environment, Social, and Governance (ESG) news headlines, articles and webinars is real. Forbes has deemed 2021 an “inflection point” for ESG. This claim is more than rhetoric. Look at the Google trend search for ESG over the last 10 years and you will see the beginnings of an exponential uptick in ESG’s popularity over the past few years.

From the SEC’s announcement of a new ESG enforcement task force to a spate of announcements of new ESG positions among leading investment firms, it is clear that key institutions are making significant investments in ESG in 2021.

All of the momentum around ESG has resulted in a “very noisy area” when it comes to ESG and mineral resources. The increased focus on ESG has been prevalent among mining industry conferences and webinars in 2021. The topic of the opening keynote address at this year’s SME conference was – you guessed it – ESG. According to keynote speaker Douglas B. Silver “ESG is more important than COVID right now.” From SME to PDAC to IMARC you’ll find entire conference tracks devoted to ESG. In any given week in 2021 you can easily fill your calendar with a half dozen webinars dedicated to ESG and mineral resources. ESG is a broad umbrella, but the topic that is grabbing the most attention right now is reporting.

The question remains – how do we measure what matters when it comes to ESG reporting?

During the opening session of SME nearly 400 attendees were asked “Do you think the new ESG initiatives are helpful or hurtful to the mining industry?” A whopping 96% majority responded that they found these initiatives to be “helpful”, and a scant 4% responded that they found the initiatives to be “hurtful.” What seems to be tipping the scales for the 4%? In a nutshell – reporting burden.

A prominent, and well-founded, concern among mining industry leaders is that efforts to meet ESG reporting requirements will be burdensome, and costly while failing to capture difficult-to-measure efforts like stakeholder engagement. As SME presenter James Hartshorn succinctly put it, “We’re in the mining business, not in the reporting business.”

A byproduct of the growing focus on ESG has been an ever-growing list of available frameworks and guidelines (UN SDGs, SASB, PRI, among many others) to report against. In addition, mining companies must determine which incoming information requests from aggregators (JUST Capital, Ethisphere, CDP) to respond to and what publicly available indexes and rankings (Sustainalytics, ISS, MSCI, Sustainable Brands Index) they want to appear on. Companies want to know which frameworks and guidelines are here to stay before committing resources. However, focusing on which reporting tools to use is putting the cart before the horse. When it comes to measuring ESG in the mining sector the following key questions about the purpose of ESG data remain unanswered:

- Is ESG about more than just risk management?

- How do companies balance different ESG priorities among local stakeholders and global investors?

- Will investors act based on ESG disclosures?

One thing everyone seems to agree on – more data is not necessarily better. How do we migrate away from an ESG reporting system that focuses on supplying institutional analysts with a high volume of data to an ESG reporting system that captures accurate, useful information that fosters good decision making for companies, investors and local stakeholders? In short- how do we cut through all of the ESG noise in order to measure what matters?